HOW CLOUD COMPUTING HAS CHANGED THE FACE OF MODERN DAY FINTECH OPERATIONS

Cloud

computing is an umbrella term used for the delivery of computing services over the

Internet, rather than the traditional method of providing computing resources via a

client-server approach. This method is used by many fintech industry players and banks

because of the benefits offered by cloud technology.

Fintech: A Revolution in Technology

Fintech startups

have been disrupting the financial service industry over the last couple of years and have already

changed the way we pay for things. With the emergence of mobile phones as an all-in-one device, the

need to carry large amounts of cash or a bulky wallet has reduced. Of course, one can argue that the

cards still have a long way to go, but the fact is that the number of payments made with cards is

growing steadily and the level of trust in transactions is increasing. The need to carry cash is

reducing, and the card is the preferred mode of payment for many. However, the current form of

payment is slow and expensive, and that’s where the financial technology

(fintech) industry comes into play. The growth of fintech over the last couple of years has

been phenomenal, and the payments industry is one of the areas that has been disrupted. This blog is

an attempt to understand some of the digital payment trends in 2022.

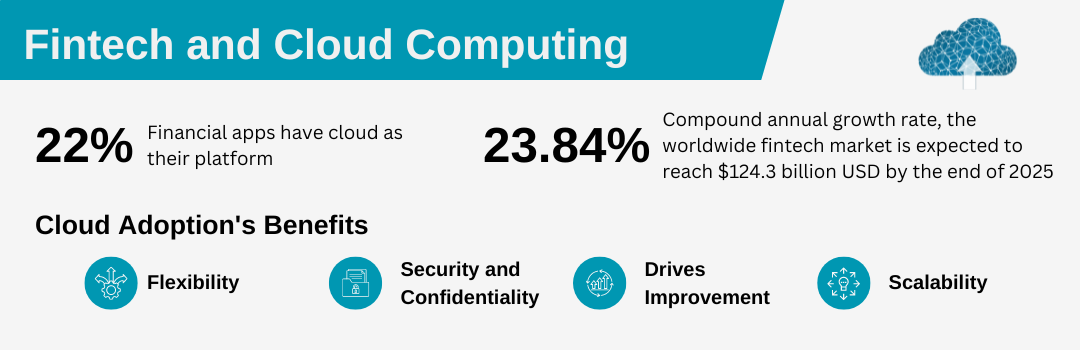

Cloud computing and its impact on fintech.

Cloud computing has had

a profound impact on the financial technology sector. By allowing businesses to access powerful

computing resources on demand, cloud computing has made it possible for fintech companies to develop

and deploy sophisticated applications quickly and cost-effectively. This has helped to accelerate

the pace of innovation in the sector and has made it possible for new players to enter the market

and challenge established incumbents.

The cloud has also enabled fintech companies to offer their services on a pay-as-you-go basis, which

has made them more accessible and affordable for consumers and businesses alike. This has helped to

drive the adoption of fintech services and has made them an integral part of the financial services

ecosystem.

Looking to the future, it is clear that cloud computing will continue to play a pivotal role in the

development of the fintech sector. With the help of the cloud, fintech companies will be able to

continue to innovate and bring new and exciting products and services to market.

User’s data storage issue is a history now.

Cloud technology has

been a game-changer for the financial technology (fintech) industry. One of the biggest challenges

faced by fintech companies has been data storage. Financial data is sensitive and needs to be stored

securely. The cloud has made it possible for fintech companies to store data securely and access it

from anywhere in the world. This has made fintech companies more agile and efficient. Cloud

technology has also made it possible for fintech companies to offer new and innovative services to

their customers.

Fintech users have long struggled with data storage issues. The desirable cloud computing data

storage facility has made sure that those issues are now a thing of the past. With cloud technology,

users can store their data securely and access it from anywhere in the world. This is a huge

advantage for fintech users, who can now use their data to make better financial decisions.

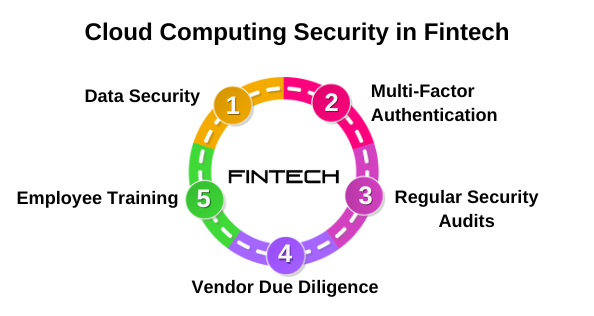

The data of fintech users are now more secure with Cloud Computing Technology

With the

advent of cloud computing technology, the data of fintech users is now more secure than ever

before. This is because cloud computing technology provides a number of security features

that were not available with traditional data storage methods. For example, cloud computing

technology allows the encryption of data, which ensures that only authorized individuals can

access it. Additionally, cloud computing technology provides for the storage of data in a

secure and isolated environment, which further protects it from unauthorized access.

Conclusion

Cloud computing and AI are the future of fintech businesses, allowing faster risk assessment and making better investments faster and more efficiently for companies. We have seen its implementation in a number of different industries, and now we are seeing its implementation in fintech. Cloud computing technology is the next step to innovation in fintech. This is because cloud computing allows the fast-moving nature of financial institutions to keep up with the pace of technology, and it has brought a revolution in the cost of implementation. In traditional systems, the cost of implementation is too high. But in cloud computing, the cost of implementation is much less than in the former. It provides full security for the data. The disaster recovery process is also very easy. Cloud computing is useful for small and large businesses, and it has already made great changes to the world of fintech.